Chapter2 Transaction Processing in the AIS

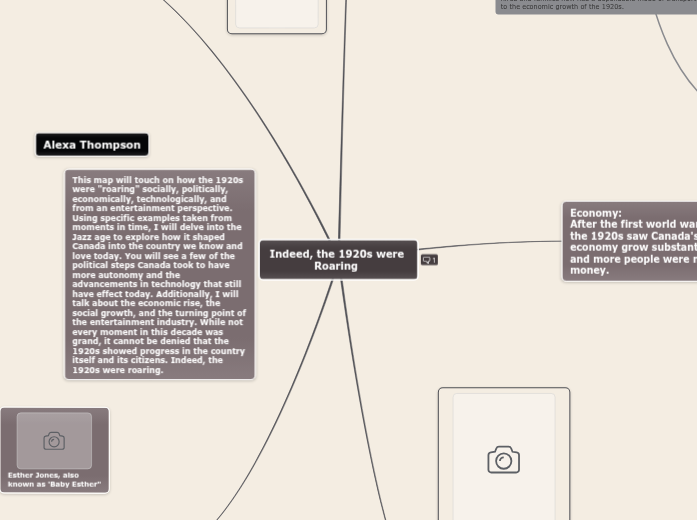

Human Judgment and information technology

Information Technology

used to

General financial statements and other reports

Close nominal accounts

Post transactions

Not essential in the accounting cycle

Useful and common

Human Judgment

Essential in the accounting cycle

Used to

Estimating ampunts and interpreting accounting rules

Recognizing recordable transactions

Designing source documents

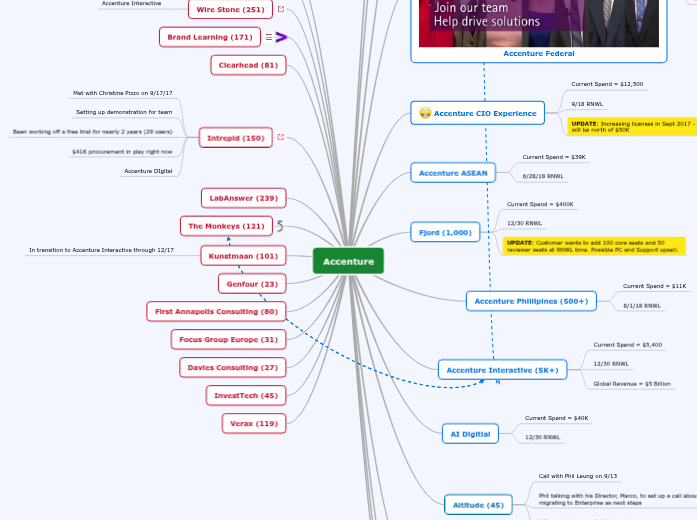

Coding systems

Commonly applied to

Chart of accounts

Inventory items

Source documents

Mnemonic codes--by their nature

Used for inventory items

Memory aid

Hierarchical codes--more sophisticated

Used for complex chart of accounts

Specializws form of block coding

Block coding--quite common

Often for chart of accounts

Codes assigned in blocks

Sequential coding--simply numbers items in sequence

Often foe source documents

Numbers in order

The accounting cycle

Transaction types

External treansactions

Internal transactions

Other internsl controls

Information technology controls

Audits

Proper authorizations

Common source documents

Transaction limits

Physical security

Sequential numbering

Closing entries

Balances in temporary accounts transferred to Retained Earnings

Dividends

Expenses

Revenues

Prepare the AIS for a new fiscal year

Financial Statements

Statement if changes in equity--same period of time as income statement

Statement of cash flows

Financing

Investing

Operating

Balance sheet--Financial position at a specific point in time

Income statement--financial activity on the accrual basis for a specified period of time

Adjusting entries

Types

Estimates

Uncolletible accounts

Depreciation

Credit Contra asset

Deferrals--cash first, service second

Prepaid Expense

Credit Asset

Debit Liability

Accruals--service first,cash second

Expense

Credit Liability

Debit Expense

Revenue

Credit Revenue

Debit Asset

Purpose--To account for timing differences between cash flow and accrual basis revenue&expense

Important steps

End of the fiscal year

Prepare post-closing trial balance

Record and post closing entries

Prepare financial statements

Prepare adjusted trial balance

Record and post adjusting entries

Throughout the fiscal year

Prepare a trial balance

Post to the ledger

Record transactions in the journal

Analyze transactions

Obtain transaction information from source documents

Steps completed each period to :

Prepare general purpose financial statements.

Record transactions in the AIS;

Measure related dollar amounts;

Identify recordable transactions;

Differentiate Accounting and Bookkeeping

Bookeeping

It's part of accounting; not it's totality.

The elements of accounting associated with

Accounting

By users of the information.

Economic information to permit informed judgments and decisions

The process of

Communicating

Measuring

Identifying