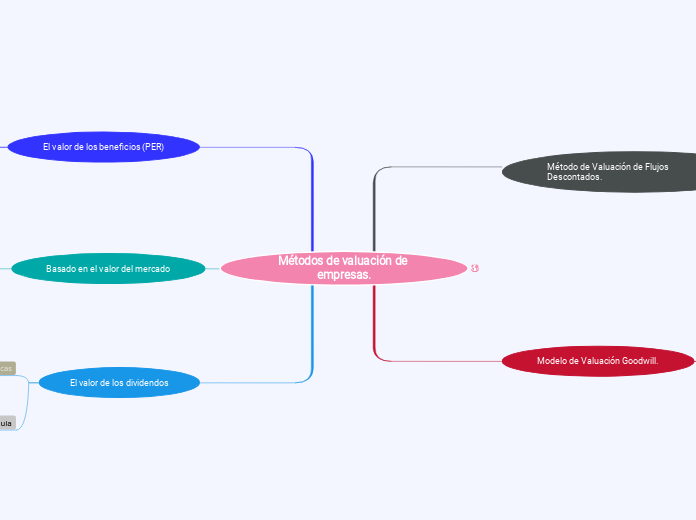

Métodos de valuación de empresas.

The Solar System is the gravitationally bound system of the Sun and the objects that orbit it, either directly or indirectly. Of the objects that orbit the Sun directly, the largest are the eight planets, with the remainder being smaller objects, the dwarf planets, and small Solar System bodies.

El valor de los dividendos

Saturn is known most for its rings.

Galileo Galilei first thought it was an object with three parts: a planet and two large moons on either side.

Not knowing he was seeing a planet with rings, the stumped astronomer entered a small drawing — a symbol with one large circle and two smaller ones — in his notebook.

The rings are made of ice and rock and scientists are not yet sure how they formed. The gaseous planet is mostly hydrogen and helium.

Valor de una acción= el valor del dividendo / rentabilidad de la accion

How long does it take for Saturn to go around the sun?

Para ello, hay que calcular el dividendo que aporta cada acción de la compañía y dividirlo por la rentabilidad exigida por el accionista

A planet's day is the time it takes the planet to rotate or spin once on its axis.

Write down Saturn's day measured in Earth days.

A través de este método se calcula el valor de la empresa en función a los dividendos por acción que se espera obtener.

Basado en el valor del mercado

Uranus is an oddball. It has clouds made of hydrogen sulfide, the same chemical that makes rotten eggs smell so foul.

It rotates from east to west like Venus. Its tilt causes extreme seasons that last 20-plus years, and the sun beats down on one pole or the other for 84 Earth-years at a time.

Methane in the atmosphere gives Uranus its blue-green tint. It also has 13 sets of faint rings.

Caracteristicas

Se suele realizar su valoración por múltiplos, que son métodos llamados comparativos.

Estas valoraciones son sencillas cuando las empresas cotizan en bolsa. Si no es así, es conveniente realizar la comparación con empresas que hayan realizado una transacción reciente.

La empresa se valora a través de ratios determinados en comparación con otras empresas semejantes.

A planet's day is the time it takes the planet to rotate or spin once on its axis.

Write down Uranus's day measured in Earth days.

El valor de los beneficios (PER)

Neptune is about the size of Uranus and is known for supersonic strong winds.

Neptune is far out and cold.

The planet is more than 30 times as far from the sun as Earth.

Neptune was the first planet predicted to exist by using math, before it was visually detected. Neptune is about 17 times as massive as Earth and has a rocky core.

PER= precio/ beneficio por acción

Neptune has thirteen moons that we know of and one more waiting for confirmation.

The largest moon is slightly smaller than Earth's Moon and has active volcanoes which erupt like geysers and eject nitrogen frost over the surface.

Name this moon and at least 4 others.

Se trata de determinar la relación existente entre lo que se paga por cada acción de la compañía y el beneficio que nos aporta anualmente.

How long does it take for Neptune to go around the sun?

Es útil para valorar empresas con cotización en Bolsa.

A planet's day is the time it takes the planet to rotate or spin once on its axis.

Write down Neptune's day measured in Earth days.

PER: Price-to-Earnings Ratio (relación de precio por ganancias)

Modelo de Valuación Goodwill.

Mars is a cold, desert-like place covered in dust. This dust is made of iron oxides, giving the planet its iconic red hue.

Mars shares similarities with Earth: It is rocky, has mountains, valleys and canyons, and storm systems ranging from localized tornado-like dust devils to planet-engulfing dust storms.

V empresa = Valor Patrimonial + Fondo de comercio ajustado

VE = A + an * ( B − Rf * A ) ( 1 )

Mars has two small moons.

Name these moons.

Siendo

A = Valor patrimonial

an = Factor de actualización de n anualidades

B = Beneficio neto

Rf = Tasa libre de riesgo

Características

El valor de la empresa es igual a su valor patrimonial ajustado a valores de mercado más el Fondo de comercio, solo que el cálculo de este último lo realiza de forma distinta

How long does it take for Mars to go around the sun?

Lo forman entre otros, los clientes, la razón social, la ubicación de la empresa.

A planet's day is the time it takes the planet to rotate or spin once on its axis.

Write down Mars's day measured in Earth days.

El Fondo de Comercio o Goodwill según el Plan General Contables es el “Conjunto de elementos intangibles o inmateriales de la empresa que implican valor para esta.

Método de Valuación de Flujos Descontados.

Mercury is the smallest, only a little bit larger than Earth's moon. Mercury has no moon.

It experiences dramatic changes in its day and night temperatures: Day temperatures can reach a scorching 840 F (450 C), which is hot enough to melt lead. Meanwhile, on the night side, temperatures drop to minus 290 F (minus 180 C).

It also has a very thin atmosphere of oxygen, sodium, hydrogen, helium, and potassium and can't break-up incoming meteors, so its surface is pockmarked with craters, just like the moon.

Características.

Our Solar System has eight “official” planets which orbit the Sun.

Each planet is at a different distance from the sun. Name its position.

El valor de la empresa se calcula con base en la estimación de los flujos de caja que la operación de la empresa prevé generar una vez descontadas las inversiones de capital que serán requeridas para la generación de estos flujos.

Formula

WACC = E * Re + D * Rd * (1 - Tc)

Re= Costo de capital

Rd= Costo de la deuda

E= Valor de mercado del capital

V= Valor de mercado de la deuda

E/V= Porcentaje de la deuda en la estructura

D/V= Porcentaje de capital en la estructura

Tc= Tasa de impuestos