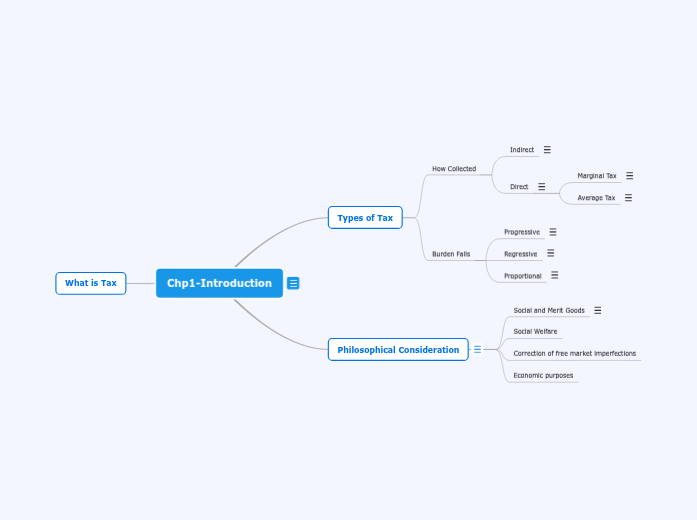

Chp1-Introduction

Types of Tax

How Collected

Indirect

Direct

Marginal Tax

Average Tax

Burden Falls

Progressive

Regressive

Proportional

Philosophical Consideration

Social and Merit Goods

Social Welfare

Correction of free market imperfections

Economic purposes